USA Salary Tax Calculator

Tax Breakdown (USA)

Knowing exactly Salary Tax Calculator how much you take home on your paycheck shouldn’t feel like you are trying to decipher hieroglyphics. But, every day there are millions of Americans contemplating the complexities of “how much tax am I going to have to pay on my salary? The IRS suggests that there are over 150 million individual tax returns filed each year, and payroll tax confusion is a major contributor to filing mistakes. While understanding taxes is never straightforward, whether it’s via an Ohio salary tax calculator or a Chicago salary tax calculator, it’s completely overwhelming.

If your take-home pay calculator shows you what you will take home, this has an impact on every financial decision you will make. Specifically, knowing what your “take home” is, is foundational when it comes to budgeting your monthly expenses (what you can afford), planning how much to contribute to retirement (when you’re ready to retire), and estimating acceptable levels of expense when it comes to what you need for a diploma or degree. Most calculators will only give generalized numbers and statistics about the items you need to deduct, how your state taxes may be different, or just guessing on how to maximize your take home.

This ultimate guide for the US salary tax calculator is not going to just provide the calculator numbers. Instead, you will learn techniques that most financial advisors charge hundreds of dollars to explain. We will provide everything from federal tax rates varying between 0% and 37% that may account for your net calculation, to nuances that individual states apply when calculating your net income. By the end of this guide, you will be able to operate your payroll tax calculator effectively like a veteran CPA.

How to Use a Salary Tax Calculator: Step-by-Step Guide

Mastering your salary tax calculator transforms confusing numbers into crystal-clear financial planning. The process begins with gathering essential information that directly impacts your tax computation process. Your gross salary, filing status, and state of residence create the foundation for accurate calculations. However, most people overlook critical details that skew their results significantly.

Start by selecting the appropriate calculator for your location. A Washington salary tax calculator differs substantially from a Maryland salary tax calculator due to varying state tax structures. Washington residents enjoy zero state income tax, while Maryland imposes both state and local taxes. Similarly, if you’re using a salary tax calculator Seattle versus a salary tax calculator DC, you’ll encounter different municipal tax requirements that affect your final net pay calculator with deductions results.

The tax computation tool requires specific inputs for maximum accuracy. Enter your complete annual salary including base pay, expected bonuses, and commission income. Don’t forget to include employer contributions to retirement plans and health insurance premiums. These pre-tax deductions significantly reduce your taxable income and shouldn’t be overlooked. Many users make the mistake of entering only their base salary, resulting in inflated tax estimates that cause unnecessary financial stress.

| Essential Calculator Inputs | Why It Matters | Common Mistakes |

|---|---|---|

| Gross Salary | Determines tax bracket placement | Forgetting bonus income |

| Filing Status | Affects standard deduction amounts | Using outdated status |

| State of Residence | Impacts state income tax calculations | Ignoring local taxes |

| Pre-tax Deductions | Reduces taxable income | Missing HSA contributions |

Understanding Federal Income Tax Brackets and Rates for 2025

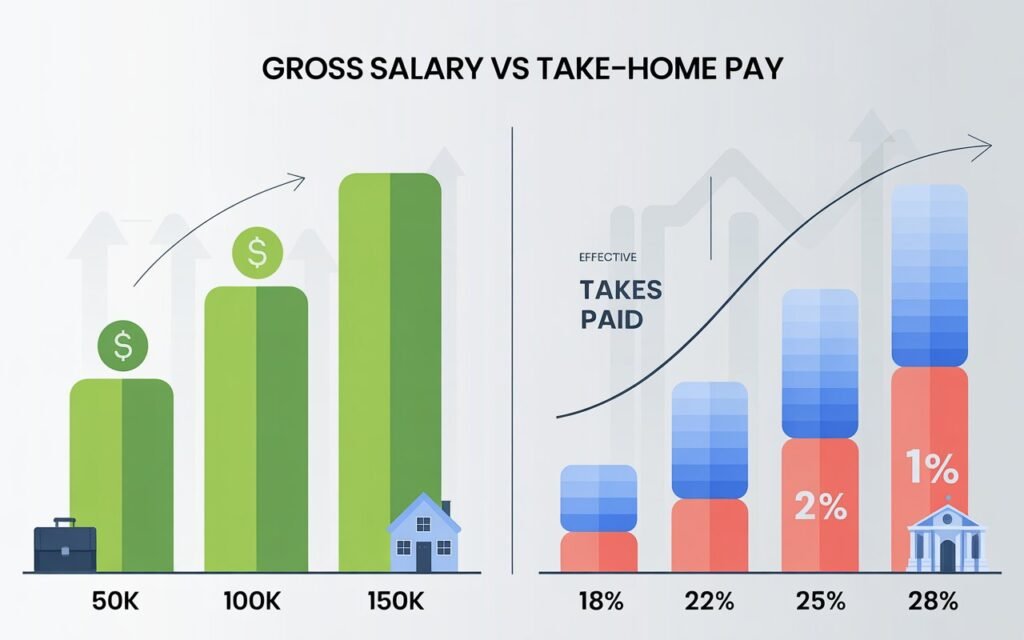

Federal tax brackets operate like a financial staircase—you’ll climb higher rates as income increases. The progressive taxation system ensures that higher earners contribute proportionally more while protecting lower-income families. For tax year 2025, the federal tax rates span from 0% to 37%, with specific thresholds determining your marginal tax rate placement.

Understanding the difference between marginal tax rate and effective tax rate prevents common misconceptions about tax liability. Your marginal rate represents the percentage applied to your last dollar earned, while your effective rate shows your overall tax burden as a percentage of total income. For example, a single filer earning $80,000 falls into the 22% marginal bracket but maintains an effective rate around 13.8% due to progressive taxation mechanics.

The 2025 tax brackets for single filers demonstrate this progression clearly. According to the IRS Publication 15 (2025), income up to $11,000 faces 0% taxation through the standard deduction. The Tax Foundation confirms that earnings from $11,001 to $44,725 incur 10% taxation. The 12% bracket covers $44,726 to $95,375, followed by 22% for income between $95,376 and $182,050. Higher brackets of 24%, 32%, 35%, and 37% apply to increasingly larger incomes, ensuring wealthy individuals contribute their fair share while maintaining economic incentives for growth.

| 2025 Tax Brackets (Single Filers) | Tax Rate | Income Range |

|---|---|---|

| Standard Deduction | 0% | $0 – $14,600 |

| First Bracket | 10% | $14,601 – $22,275 |

| Second Bracket | 12% | $22,276 – $89,450 |

| Third Bracket | 22% | $89,451 – $190,750 |

| Fourth Bracket | 24% | $190,751 – $364,200 |

| Fifth Bracket | 32% | $364,201 – $462,500 |

| Sixth Bracket | 35% | $462,501 – $693,750 |

| Seventh Bracket | 37% | $693,751+ |

State Income Tax Calculations: A Complete Breakdown

State taxes create a patchwork quilt of complexity across America’s financial landscape. While a Nevada salary tax calculator shows zero state income tax, a Minnesota salary tax calculator reveals rates reaching 9.85% for high earners. These dramatic differences significantly impact your take-home pay and should influence major life decisions like job relocations or retirement planning.

Nine states currently impose no state income tax: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. Residents of these states using a Washington DC salary tax calculator or Iowa salary tax calculator for comparison purposes often discover substantial savings opportunities. However, these tax-free states frequently compensate through higher sales taxes, property taxes, or other fees that may offset income tax advantages.

High-tax states like California, New York, and Hawaii implement progressive taxation systems that mirror federal structures. A North Carolina salary tax calculator shows a flat 4.75% rate, while neighboring states employ graduated systems. State-specific tax rates range from flat percentages to complex multi-bracket systems with rates exceeding 13% in extreme cases. Local municipalities add another layer of complexity, with cities like New York implementing additional taxes that require specialized calculators for accurate projections.

| State Tax Structure Examples | Tax Rate | Special Considerations |

|---|---|---|

| Washington State | 0% | No state income tax |

| North Carolina | 4.75% | Flat rate system |

| Minnesota | 5.35% – 9.85% | Progressive brackets |

| Virginia | 2% – 5.75% | Moderate progression |

| Ohio | 0% – 3.99% | Local taxes vary |

Understanding regional tax differences becomes crucial when using location-specific tools like an Arizona salary tax calculator versus an Ohio after-tax salary calculator. Arizona imposes rates from 2.59% to 4.50%, while Ohio’s structure ranges from 0% to 3.99%. These variations, combined with different standard deduction amounts and credit availability, create substantial after-tax income differences that compound over career lifespans.

Social Security and Medicare Tax Deductions

FICA taxes silently chip away at every paycheck, regardless of your income level. These mandatory contributions support America’s social safety net through Social Security tax and Medicare tax deductions. Unlike federal income taxes, FICA taxes apply to nearly all earned income with specific caps and additional surcharges for high earners.

Social Security tax operates at a fixed 6.2% rate on wages up to the wage base limit of $176,100 for 2025, as established by the Social Security Administration. Both employees and employers contribute this amount, creating a combined 12.4% contribution rate. Once your annual salary exceeds the wage base limit, Social Security tax stops accumulating, providing high earners with effective tax relief on additional income. This cap mechanism explains why executives and business owners often structure compensation to maximize this benefit.

Medicare tax follows different rules with no income ceiling. The standard 1.45% rate applies to all wages, matched by employer contributions for a total 2.9% contribution. However, high earners face an additional 0.9% Medicare tax on income exceeding $200,000 for single filers or $250,000 for married couples filing jointly. This additional Medicare tax receives no employer matching, creating a 2.35% effective rate for affected taxpayers.

| FICA Tax Component | Employee Rate | Employer Rate | Income Limit (2025) |

|---|---|---|---|

| Social Security | 6.2% | 6.2% | $176,100 |

| Medicare | 1.45% | 1.45% | No limit |

| Additional Medicare | 0.9% | 0% | $200,000+ (single) |

| Combined Rate | 7.65% | 7.65% | Varies by income |

Self-employed individuals face unique FICA tax obligations through the Self-Employment Contributions Act. They pay both employee and employer portions, creating effective rates of 12.4% for Social Security and 2.9% for Medicare. However, they can deduct the employer portion as a business expense, slightly reducing their overall tax burden. This complexity requires specialized calculators or professional guidance for accurate payroll tax calculation.

Pre-Tax Deductions That Reduce Your Taxable Income

Strategic pre-tax deductions function like financial shields, protecting income from taxation. These deductions reduce your taxable income before calculating federal, state, and FICA taxes, creating immediate savings that compound throughout your career. Understanding available options and maximizing contributions significantly improves your net income without requiring salary increases.

Employer contributions to retirement plans represent the most powerful pre-tax deduction opportunity. 401(k) plans allow contributions up to $23,000 for 2025, with an additional $7,500 catch-up contribution for employees over 50. These contributions directly reduce your taxable income, potentially dropping you into lower tax brackets and reducing your overall tax liability. Many employers offer matching contributions, essentially providing free money that doubles your retirement savings rate.

Health-related pre-tax deductions offer triple tax advantages through Health Savings Accounts (HSAs). Contributions reduce current taxable income, earnings grow tax-free, and qualified withdrawals incur no taxes. HSA contribution limits reach $4,150 for individual coverage and $8,300 for family coverage in 2025. Unlike Flexible Spending Accounts (FSAs) with use-or-lose provisions, HSA funds roll over indefinitely, creating powerful long-term wealth-building opportunities for medical expenses and retirement planning.

Additional pre-tax deductions include dependent care assistance programs, transportation subsidies, and certain insurance premiums. Dependent care FSAs allow up to $5,000 in annual contributions for qualifying childcare expenses. Commuter benefits cover parking and public transportation costs up to specific monthly limits. These programs may seem small individually, but their cumulative impact on tax withholding and take-home pay creates meaningful financial improvements over time.

Pre-Tax vs. Post-Tax Benefits Comparison

Understanding deduction timing unlocks substantial salary tax savings potential. Pre-tax deductions reduce your current tax liability but create taxable income when withdrawn during retirement. Post-tax contributions like Roth IRA investments use after-tax dollars but provide tax-free withdrawals in retirement. The optimal strategy depends on your current tax bracket versus expected retirement tax rates.

Consider a practical example using a bonus and salary tax calculator scenario. An employee earning $75,000 annually in the 22% marginal tax rate bracket contributes $6,000 to their 401(k). This pre-tax deduction saves $1,320 in federal taxes plus state tax savings and FICA tax reductions on the contributed amount. The same $6,000 contributed to a Roth IRA provides no immediate tax benefit but creates tax-free retirement income.

Tax deduction optimization requires analyzing your complete financial picture, including expected retirement income, current tax burden, and available employer benefits. Young professionals in lower tax brackets might favor Roth contributions, while high earners benefit more from traditional pre-tax deductions. Many financial advisors recommend diversifying across both strategies to create tax flexibility during retirement when income needs vary significantly.

Standard Deduction vs. Itemized Deductions for 2025

Choosing between standard deduction and itemized deductions resembles selecting the right financial pathway. The decision directly impacts your taxable income and overall tax liability, making it crucial for optimizing your salary tax calculator results. Most taxpayers benefit from the standard deduction, but certain situations make itemizing worthwhile despite additional complexity.

The standard deduction for 2025 reaches $14,600 for single filers, $29,200 for married couples filing jointly, and $21,900 for heads of household. These amounts increase annually with inflation adjustments, providing automatic tax relief without requiring detailed record-keeping. The Tax Cuts and Jobs Act nearly doubled these amounts, making itemizing beneficial for fewer taxpayers than in previous years.

Itemized deductions become advantageous when their total exceeds your standard deduction amount. Common itemizable expenses include mortgage interest, state and local tax payments (capped at $10,000), charitable contributions, and certain medical expenses exceeding 7.5% of adjusted gross income. High-income taxpayers in states with significant state income tax often benefit from itemizing, particularly when combined with substantial charitable giving or mortgage interest payments.

| Filing Status | Standard Deduction 2025 | When to Consider Itemizing |

|---|---|---|

| Single | $14,600 | Deductions exceed $14,600 |

| Married Filing Jointly | $29,200 | Combined deductions exceed $29,200 |

| Married Filing Separately | $14,600 | Spouse itemizes or exceeds $14,600 |

| Head of Household | $21,900 | Deductions exceed $21,900 |

The itemization decision affects state tax calculations differently across jurisdictions. Some states require federal tax conformity, while others allow independent choices. A Kentucky salary tax calculator might show different results based on your deduction election, while a Swiss salary tax calculator operates under entirely different principles. Always consider both federal and state implications when making this crucial decision.

Salary vs. Hourly: Different Tax Calculation Methods

Employment structure dramatically influences your salary tax calculator approach and results. Salaried employees receive consistent bi-weekly paychecks or semi-monthly pay periods, while hourly workers face variable income that complicates tax withholding calculations. Understanding these differences ensures accurate payroll tax planning and prevents year-end surprises.

Hourly wage conversion to annual equivalents requires careful consideration of actual work patterns. A worker earning $25 per hour for 40 hours weekly generates $52,000 annually (2,080 hours). However, overtime calculations at time-and-a-half rates significantly boost total compensation. Overtime hours exceeding 40 per week earn $37.50 per hour, creating substantial income variations that affect tax bracket placement and withholding accuracy.

Bonus tax calculations present unique challenges regardless of employment structure. Employers often apply supplemental tax rates to bonuses, resulting in higher withholding percentages than regular wages. A $5,000 bonus might face 22% federal withholding plus state taxes and FICA taxes, creating immediate cash flow impacts. However, year-end tax reconciliation often produces refunds when withholding exceeds actual tax liability based on total annual income.

Multiple income sources complicate tax planning for gig economy workers and part-time employees. Someone working hourly retail while freelancing online must coordinate withholding across income streams. A Philippines salary tax calculator won’t help with US tax obligations, but understanding coordination principles prevents under-withholding penalties and cash flow problems during tax season.

Advanced Tax Planning Strategies for Maximum Savings

Sophisticated tax planning strategies separate financial winners from average earners. These advanced techniques require understanding complex interactions between federal, state, and local tax systems. Successful implementation can save thousands annually while building long-term wealth more effectively than simple salary tax calculator usage alone.

Tax-loss harvesting allows investors to offset capital gains with investment losses, reducing overall tax burden. This strategy works particularly well for high earners in the 37% bracket who also face additional Medicare taxes. By strategically selling losing investments to offset gains, you can reduce taxable income while rebalancing your portfolio. The savings can then fund additional pre-tax deductions or Roth conversions during lower-income years.

Income timing strategies become crucial for variable earners like consultants or commissioned salespeople. Deferring year-end bonuses or accelerating expenses can shift taxable income between tax years, potentially dropping you into lower tax brackets. This approach requires careful coordination with employer contributions and withholding adjustments to avoid penalties while maximizing after-tax income over multiple years.

Retirement account optimization involves sophisticated strategies like backdoor Roth conversions and mega-backdoor Roth contributions. High earners exceeding Roth IRA income limits can contribute to traditional IRAs and immediately convert to Roth accounts. Similarly, after-tax 401(k) contributions can be converted to Roth accounts, creating powerful wealth-building opportunities that bypass normal contribution limits while providing tax-free growth potential.

Common Tax Calculator Errors and How to Avoid Them

Even seasoned professionals stumble into tax calculator pitfalls that distort financial planning. These errors range from simple input mistakes to fundamental misunderstandings about tax law mechanics. Recognizing common problems helps you avoid costly mistakes while maximizing your take-home pay optimization efforts.

Filing status errors represent the most frequent calculator mistakes. Single individuals cannot claim head of household status without qualifying dependents, while married couples must coordinate their elections carefully. Using the wrong status affects standard deduction amounts, tax bracket thresholds, and credit eligibility. A married person using single status in a Denmark salary tax calculator comparison would generate completely inaccurate results for actual US tax planning.

Withholding miscalculations create cash flow problems throughout the year. Over-withholding provides forced savings through large refunds but reduces monthly spending power. Under-withholding creates quarterly payment obligations and potential penalties. The key involves balancing current cash flow needs with year-end tax obligations through careful Form W-4 completion and regular withholding reviews.

State tax complications multiply when using inappropriate calculators for your situation. A Netherlands salary tax calculator won’t help with US obligations, while a Virginia salary tax calculator provides inaccurate results for Maryland residents working across state lines. Multi-state situations require specialized tax computation tools or professional guidance to ensure compliance and optimization across jurisdictions.

Professional consultation becomes necessary when calculator results seem inconsistent or your situation involves complex factors like stock options, foreign income, or multi-state employment. Tax preparation services provide value through advanced tax planning strategies that basic calculators cannot address. The cost of professional advice often pales compared to potential savings from sophisticated optimization techniques.

Frequently Asked Questions About Salary Tax Calculations

How to Calculate tax on salary in the USA?

US income tax is calculated using progressive tax brackets on your taxable income (gross income minus deductions). You’ll also pay Social Security (6.2%) and Medicare (1.45%) taxes on earned income. State taxes vary by location, with some states having no income tax while others charge up to 13.3%. Use tax software or consult the IRS tax tables for precise calculations.

How do you Calculate US income tax?

Start with your gross income, subtract standard or itemized deductions to get taxable income. Apply the progressive tax rates to different income brackets – you pay 10% on the first portion, 12% on the next, and so on. Add Social Security and Medicare taxes (7.65% total), plus any applicable state and local taxes. The result is your total tax liability.

How much is the tax on $100,000 in the US?

For a single filer earning $100,000 in 2024, federal income tax is approximately $17,400, plus $7,650 in Social Security/Medicare taxes, totaling about $25,050 in federal taxes. This assumes the standard deduction and no other tax credits. State taxes would be additional depending on your location.

How much tax on 200k salary in the USA?

A single filer earning $200,000 would pay approximately $42,000 in federal income tax plus $10,700 in Social Security/Medicare taxes (with Medicare surtax), totaling around $52,700 in federal taxes. This represents an effective federal tax rate of about 26%. State taxes would add significantly more in high-tax states.

How much is 200k after taxes in California?

After federal taxes (~$52,700) and California state taxes (~$16,000), a $200,000 salary would net approximately $131,300. California has high state income tax rates up to 13.3%, plus additional local taxes in some areas. The exact amount depends on deductions, filing status, and specific location within California.

What tax bracket is $100,000 married?

For married filing jointly in 2024, $100,000 falls into the 12% tax bracket (which covers income from $23,200 to $94,300) and the 22% bracket (starting at $94,301). However, only the income above $94,301 is taxed at 22%. The effective tax rate would be much lower than 22% due to the progressive system.

Does making 100k put you in a different tax bracket?

Yes, earning $100,000 as a single filer puts you in the 24% tax bracket for 2024 (which starts at $100,525). However, only income above the bracket threshold is taxed at the higher rate. Your effective tax rate remains lower than 24% because lower portions of your income are taxed at lower rates.

What do I owe in taxes if I made $120000?

A single filer earning $120,000 would owe approximately $22,500 in federal income tax plus $9,180 in Social Security/Medicare taxes, totaling about $31,680 in federal taxes. This assumes standard deduction and no additional credits. Your actual liability may vary based on deductions, credits, and withholdings throughout the year.

Is your entire income taxed at the same rate?

No, the US uses a progressive tax system where different portions of your income are taxed at different rates. For example, the first $11,000 is taxed at 10%, the next portion at 12%, and so on. Only the income that falls within each bracket is taxed at that bracket’s rate, not your entire income.

Should I claim 1 or 0 if single?

This refers to withholding allowances on the old W-4 form. Generally, claiming 0 meant more taxes withheld (larger refund), while 1 meant less withheld (smaller refund but more take-home pay). The current W-4 uses a different system, but the principle remains: adjust withholdings based on whether you prefer larger paychecks or tax refunds.

What is the highest federal tax rate?

The highest federal income tax rate for 2024 is 37% for single filers earning over $609,350 and married couples earning over $731,200. Additionally, high earners pay a 3.8% Net Investment Income Tax and 0.9% additional Medicare tax. Some taxpayers may also face Alternative Minimum Tax (AMT) at rates up to 28%.

Is social security taxed?

Social Security benefits may be taxable depending on your total income. If your combined income (adjusted gross income + nontaxable interest + half of Social Security) exceeds $25,000 (single) or $32,000 (married filing jointly), up to 50% of benefits are taxable. Above $34,000 (single) or $44,000 (married), up to 85% may be taxable.

FOR MORE TOOLS JUST VISIT : TOOLYBIRD